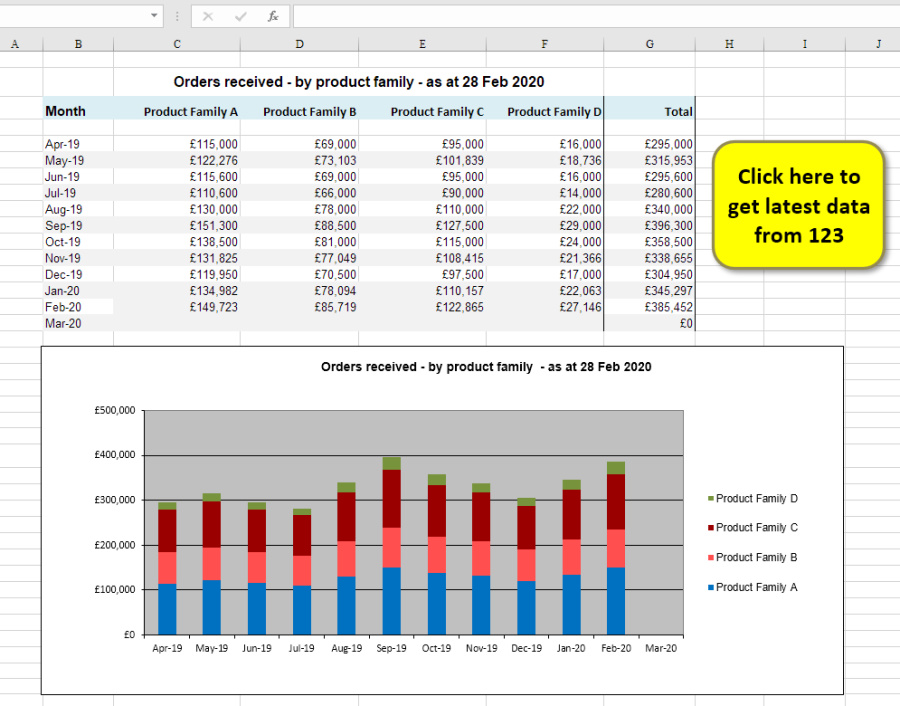

stock valuation

An MRP system will give you a detailed stock valuation but many companies want to make adjustments, particularly for slow moving stock.

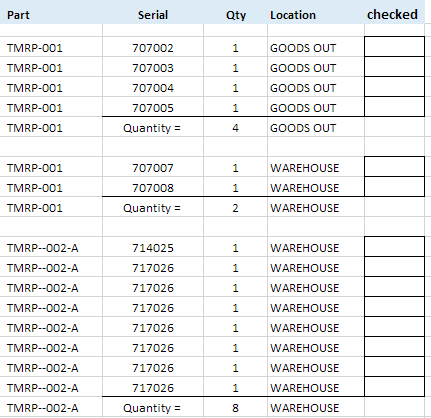

You may benefit from a customised stock count report organised to match your stores layout for easier counting. Do you need serial numbers on your stock count report?

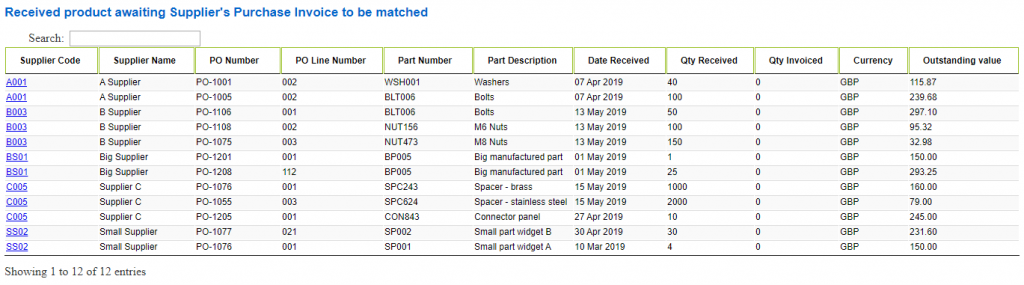

Are you matching purchase invoices in 123. A disciplined approach through the year reduces the queries at year end. A web report that everyone can see showing goods booked in but not yet invoice matched will make life easier.